Definition of TAA Substantial Transformation Country of Origin Test Under the Trade Agreements Act and FAR 52.225-5

Theodore P. Watson, Esq. The Trade Agreements Act of 1979 (TAA), TRADE AGREEMENTS ACT OF 1979, U.S. Code 19 (2011), §§ 2501-2582, is an important piece of legislation that affects international trade. Understanding the concept of TAA substantial transformation country of origin or significant change under FAR 52.225-5 if you are involved in federal government contracting is crucial for businesses aiming to comply with the TAA.

Theodore P. Watson, Esq. The Trade Agreements Act of 1979 (TAA), TRADE AGREEMENTS ACT OF 1979, U.S. Code 19 (2011), §§ 2501-2582, is an important piece of legislation that affects international trade. Understanding the concept of TAA substantial transformation country of origin or significant change under FAR 52.225-5 if you are involved in federal government contracting is crucial for businesses aiming to comply with the TAA.

The Trade Agreements Act focuses on restricting what sources manufacturers and resellers can use to import goods into the country. To meet TAA important and compliance standards, products must undergo a substantial transformation in the United States or another designated country before they are brought into the United States. To be TAA compliant, this transformation must be substantial enough to create a product with an entirely new name, character, and use from its original processing source material.

- Avoid making the mistake of trying to get around the substantial transformation rules by developing non-manufacturing phases in the US where courts may disagree.

- Every TAA compliant rules for a substantial transformation case must be analyzed on a case-by-case basis.

- Federal law enforcement agencies have increased oversight on TAA compliance and cases involving substantial transformation.

AVOID JAIL TIME AND HUGE FINES - GET TAA COMPLIANT TODAY - GET STARTED HERE

ACETRIS HEALTH, LLC v. UNITED STATES, has narrowed the focus on what really is substantial transformation country of origin under TAA compliance rules. This case involved the government’s interpretation of TAA restrictions on the procurement of foreign-origin pharmaceutical products by the Department of Veterans Affairs (“VA”). The Trade Agreements Act of 1979 (“TAA”) bars the VA from purchasing “products of” certain foreign TAA designated countries, such as India. The Federal Acquisition Regulation (“FAR Part 25“) directs agencies to purchase “U.S.-made end products” before end products from certain foreign TAA designated countries. Important highlights of this case are as follows:

- U.S. Customs and Border Protection (CBP) does not have authority to rule on FAR Compliance

- TAA’s statutory country-of-origin test under 19 U.S.C. § 2515(b)(1), which only authorizes “determinations . . . under section 2518(4)(B) is different from the FAR’s test.

- Your products are TAA-compliant if they are “products of the United States” and have been “substantially transformed” in the United States under 19 U.S.C. 2518(4)(B) and FAR 52.225-5.

-

the CBP’s country-of-origin processing determinations are not “binding” on the contracting and agencies must conduct their “independent [country-of-origin] analysis.”

-

The procuring agency” is “responsible for determining whether an offered product qualifies as a U.S.-made end product.” Acetris, 138 Fed. Cl. at 602–03.

-

FAR § 52.2255 does not adopt the TAA’s country-of-origin processing test for determining what are “products of a foreign country or instrumentality.” 19 U.S.C. § 2518(4)(B). Instead, the FAR defines “U.S.-made end product” as “an article that is mined, produced, or manufactured in the United States or that is substantially transformed in the United States.” FAR § 25.003.

TAA Meaning

Under the Trade Agreements Act (definition of TAA), the trade agreements of foreign governments. The “designated countries” encompass signatories to World Trade Organization (WTO) Government Procurement Agreements, free trade agreements, bilateral agreements between the U.S. and other nations, or other countries listed as eligible by the Trade Representative. Additionally, if a foreign end product is used in an acquisition valued at or above $182,000, it must comply with TAA and originate from a designated country’s market. This applies to you if you are selling goods government under a TAA subject contract and offering foreign products.

To be TAA compliant substantially transformed, the VA interpreted the Trade Agreements Act and substantial transformation regulation to define the substantial transformation country of origin COO of a pharmaceutical product to be the country in which the product’s active ingredient is manufactured (India.) Acetris Health, LLC (“Acetris”) challenged the VA’s interpretation of the TAA and the FAR in a bid protest action at the United States Court of Federal Claims (“Claims Court” or “COFC”)). The COFC granted Acetris declaratory and injunctive relief, holding that the VA misinterpreted the TAA and the FAR and enjoined the VA, in future procurements, from utilizing an erroneous interpretation. Acetris Health, LLC v. United States , 138 Fed. Cl. 579, 606–07 (2018). The government appealed the case to the Court of Appeals for the Federal Circuit. See information about TAA compliance for medical products.

Transformed Definition: What is Substantially Transformed Under the Trade Agreements Act Requirements?

Transformed definition: Is your product substantially transformed? At the core of the Trade Agreements Act lies the concept of substantial transformation. The definition refers to the process by which a product undergoes significant changes in its essential character as a result of manufacturing or processing to become a new and distinct article. Identifying the substantial transformation country of origin rules and determining whether the transformation has occurred are vital steps in assessing TAA compliance.

TAA compliant rules for substantial transformation mean that the product underwent a fundamental change (normally as a result of processing or manufacturing in the country claiming origin) in its form, appearance, nature, or character, which adds to its overall value an amount or percentage that is significant in comparison to the value which the good (or its components or materials) had when exported from the country in which it was first made or grown. Usually, a new article of commerce–normally one with a different name–is found to result from any process that Customs decides has brought about a “substantial transformation” in the pre-existing components.

At our office, we want to ensure that you are well-informed about substantial transformation and its implications. TAA compliant substantially transformed refers to a significant change in a good’s form, appearance, nature, or value through processing or manufacturing. This process can result in a completely new article, often with a different name, that adds considerable value compared to its original state.

To steer clear of any potential legal issues and to better understand how this applies to your situation, we encourage you to call our office. Our team is here to provide guidance and help you navigate the complexities of customs regulations. Don’t hesitate to reach out – we’re just a phone call away!

IF YOU'RE READY TO HIRE AN ATTORNEY BOOK A CALL HERE

See information about the exceptions to the Trade Agreements Act.

Factors Influencing Substantial Transformation

Several factors come into play when evaluating substantial transformation. Physical changes and manufacturing processes play a crucial role in transforming raw materials into finished products. Additionally, changes in the harmonized system (HS) classification and the value-added criteria contribute to determining whether a transformation has taken place.

TAA Substantial Transformation Country of OriginTest Examples

To gain a better understanding, let’s explore some examples that illustrate TAA substantial transformation country of origin test. In manufacturing, a simple example could be the production of a garment. The cutting, sewing, and assembly processes significantly transform the fabric and other components into wearable articles of clothing. Case studies showcasing the impact of substantial transformation in different industries can provide further insights.

Examples as shown at the United States International Trade Commission:

- Sugar from country A, flour from country B, dairy products from country C, and nuts from country D are taken to country E and undergo manufacturing to result in cookies. (The inputs were substantially transformed into a product of country E, in that a new type of goods resulted from processing.)

- Fresh vegetables grown in various countries are taken to another country to be mixed together and frozen. (The vegetables were not substantially transformed into products of the country where mixing and freezing occurred, and the mixture must be labeled with the origin of each ingredient.)

- Repackaging, dilution with water, and similar minor processes usually do not cause a substantial transformation under FAR 52.225-5. Assembly or disassembly may result in a substantial transformation, depending on the nature of the products involved and the complexity of the operations.

Note to manufacturers and government contractor:

A country of origin, like China, should not conclude the analysis. Your opponent may challenge your product based on this fact. Our team of TAA compliance attorneys will carefully examine whether the assembly of components, of Chinese origin, in the US constitutes a significant transformation. Good judicial interpretations of substantial transformation under the TAA in government procurement cases are scarce. However, courts tend to reference decisions related to other customs matters, such as marking, when construing similar language as in the TAA. The test for substantial transformation is specific to the facts and examines whether the article has undergone a process that results in a new and distinct name, character, or use. Courts have primarily focused on changes in use or character to assess substantial transformation, regarding a change in name as the least compelling factor.

What is Country of Origin Rules for the Free Trade Agreements Act?

The TAA compliance rules determining your product’s country of origin can be met if your product is wholly grown or manufactured and assembled primarily in one country. However, if your product includes components that originate in several countries, determining the country origin can be much more difficult. This is where most manufacturers and contractors make huge mistakes and should consider engaging with a Trade Agreements Act compliance lawyers who understand country of origin criterion and processing rules.

TAA Compliant Solution and Determining Substantial Transformation Country of Origin Under FAR 52.225-5: Evaluating whether your product is TAA compliant and meeting substantial transformation requires careful consideration of various factors. Elements such as the nature and extent of the changes, the value added during the transformation process, and the significance of the final product’s new identity are all crucial aspects to assess. Guidelines and criteria established for TAA compliance aid in making informed determinations under FAR 52.225-5.

IF YOU'RE READY TO HIRE AN ATTORNEY BOOK A CALL HERE

What are TAA Compliance Laws and Country of Origin Rules for Medical Equipment?

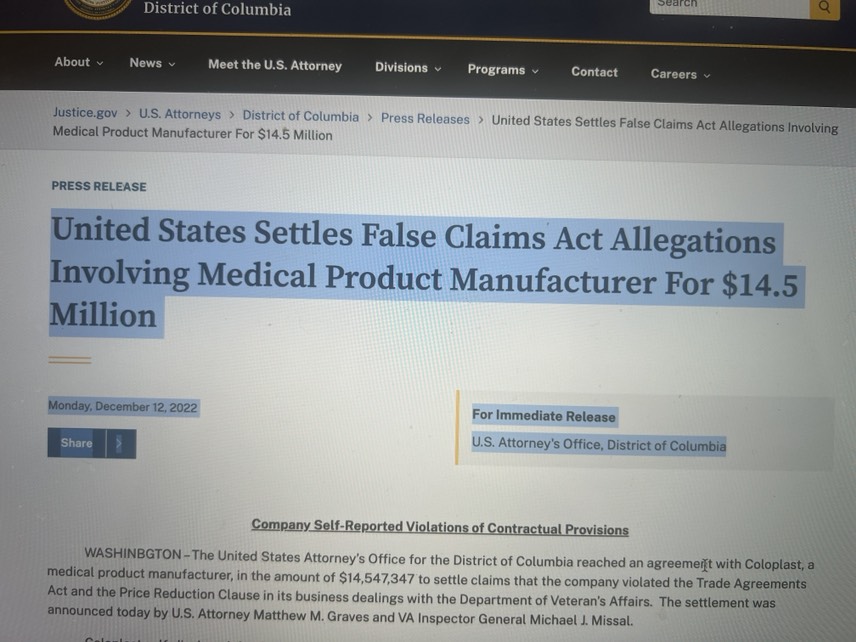

The Trade Agreements Act (TAA) import and compliance laws apply to various products, including medical equipment, when procured by the U.S. federal government. These laws determine the eligibility of medical equipment for federal government procurement and establish the requirements for TAA compliance. The DOJ and Federal Law Enforce are actively pursuing False Claims Act cases against Medical Product Manufacturers.

Here are some key aspects of TAA import and compliance laws for medical equipment:

Here are some key aspects of TAA import and compliance laws for medical equipment:

1. Country of Origin: Medical equipment must be manufactured or substantially transformed in the United States or a designated country specified in the TAA to be eligible for federal government procurement. The substantial transformation country of origin COO under FAR 52.225-5 refers to where the equipment undergoes substantial manufacturing or transformation processes.

2. TAA Designated Countries: The list of designated countries under the TAA includes members of the World Trade Organization Government Procurement Agreement (WTO GPA), certain Free Trade Agreement (FTA) partner countries, and Caribbean Basin countries. These countries have established trade agreements with the United States that make their products eligible for federal government procurement.

3. TAA Substantial Transformation: Medical equipment must undergo substantial transformation in the United States or a designated country to meet the TAA requirements. This transformation should result in a new and different product with a changed name, character, or use. Simple assembly or packaging of components may not be sufficient for substantial transformation.

4. TAA Compliance Certifications: Vendors and contractors supplying medical equipment to the federal government are often required to provide TAA compliance certifications. These certifications confirm that the equipment meets the TAA substantial transformation requirements and is eligible for procurement. Certifications typically involve verifying the country of origin and the substantial transformation processes.

5. Agency Exceptions and Waivers: Certain exceptions and waivers may apply to Trade Agreements Act compliance for medical equipment. For example, products from non-designated countries may still be eligible if covered by specific exceptions, such as products from Least Developed Countries (LDCs) or certain products with de minimis foreign content.

6. Specific Regulations: Apart from the TAA, other regulations and standards may also apply to medical equipment, such as those related to safety, FAR Trade Agreements Act regulations, quality, labeling, and certifications specific to the medical field. Compliance with these regulations is necessary in addition to TAA requirements.

It is important for vendors and contractors supplying medical equipment to the federal government to understand and adhere to the TAA import and compliance laws. Compliance certifications, due diligence in supply chains, and documentation of TAA substantial transformation are essential for ensuring TAA compliance and eligibility for federal government procurement. Consulting Trade Agreements Act attorneys and trade FAR 25 legal professionals familiar with government procurement and import laws is advisable to navigate these regulations effectively.

What is GSA’s Substantial Transformation Compliance Requirements for Software?

Federal agencies procuring commercial software, must comply with the March 2015 Trade Agreements Act (TAA). This requires ensuring that all products on a contract, including third-party software listed in the license or service, are manufactured or “substantially transformed” in a designated country. While making a TAA compliance determination for software can be challenging to determine the country of origin COO, “substantial transformation” test is used.

Substantial transformation meaning for GSA

Substantial transformation means transforming an article into a new and different article of commerce with a distinct name, character, or use from the original. It is the responsibility of the government contractor to make this determination either through the Federal agency responsible or through a third party. GSA uses the Industrial Operation’s Analysts (IOA) to validate TAA compliance, and agencies working with OEM/dealers/resellers should ask for specific representations and warranties of Trade Agreements Act compliance in connection with letters of supply. This applies to third-party software as well, and it is in the agencies’ interest not to risk GAO overturning an award based on non-compliance with the Trade Agreements Act. See how to comply with GSA TAA compliance requirements.

What are cases where companies have faced criminal penalties and false claims act liability for failing the substantial transformation country of origin test under the TAA and FAR 52.225-5?

Failing to follow TAA compliance rules with the substantial transformation meaning test can result in severe penalties. Companies have faced criminal charges and False Claims Act liability for submitting false claims to government agencies. For example, in 2013, a company was indicted under the U.S. Criminal Code and fined more than $500 million for making false statements to federal agencies about the origin of products. Similarly, in 2018, a company was charged with violating the False Claims Act and paying nearly $10 million to settle allegations of false claims related to non-compliance with Trade Agreements Act TAA requirements. Get more information on how to be TAA compliant and avoid criminal liability.

These cases demonstrate how important it is for companies to understand the substantial transformation test under the TAA compliant countries regulations and comply with its standards.

Challenges and Controversies

Determining substantial transformation under FAR 52.225-5 can sometimes be challenging, leading to controversies and legal disputes. Disagreements may arise when different interpretations of substantial transformation clash, resulting in court cases that further shape the understanding and application of the concept. It is essential for businesses to stay informed and seek legal advice when necessary. See the November 2023 Mullin Article.

Benefits of Complying with the Substantial Transformation Test

Complying with the substantial transformation meaning under the TAA offers several benefits. First and foremost, it provides access to government procurement opportunities, opening doors to potential contracts and business growth. Furthermore, compliance demonstrates adherence to international trade agreements, enhancing a company’s reputation and credibility. Finally, businesses that actively comply with the TAA gain a competitive edge in the market.

Compliance Strategies

To ensure compliance with substantial transformation requirements, businesses can employ various strategies. Establishing a clear supply chain and implementing a robust record-keeping system is essential for tracking the origin and transformation of goods. Collaborating closely with suppliers and partners can also help ensure transparency and consistent compliance. Leveraging technology, such as automation and software solutions, can streamline compliance management processes.

Future Trends and Considerations

As regulations and trade agreements evolve, it is crucial to stay informed about future trends and considerations regarding substantial transformation. Changes in the TAA or other international trade agreements can impact compliance requirements, making it necessary to adapt strategies and processes accordingly. Additionally, the role of technology and automation in the transformation process may shape the future landscape of substantial transformation.

Trade Agreements Act & GSA

Government contractors selling products to the federal government and having a GSA Schedule are subject to the Trade Agreements Act (TAA). This means that companies must be able to certify that all of its products listed on the GSA Schedule Contract are manufactured or “substantially transformed” in the United States or a TAA “designated country”. The designated TAA compliant countries are composed of:

- World Trade Organization Government Procurement Agreement Countries;

- Free Trade Agreement Countries;

- Least Developed Countries; and

- Caribbean Basin Countries

For immediate help with Trade Agreements Act requirements for your products and whether they meet the TAA substantial transformation country of origin analysis under the Trade Agreements Act and FAR 52.225-5, contact our TAA compliance lawyers at 1.866.601.5518. Speak to Theodore Watson.